an EquiDeFi® product by

Marc Goldbaum, Mohit Bhansali and Camden J. Weis (ATEM Group)

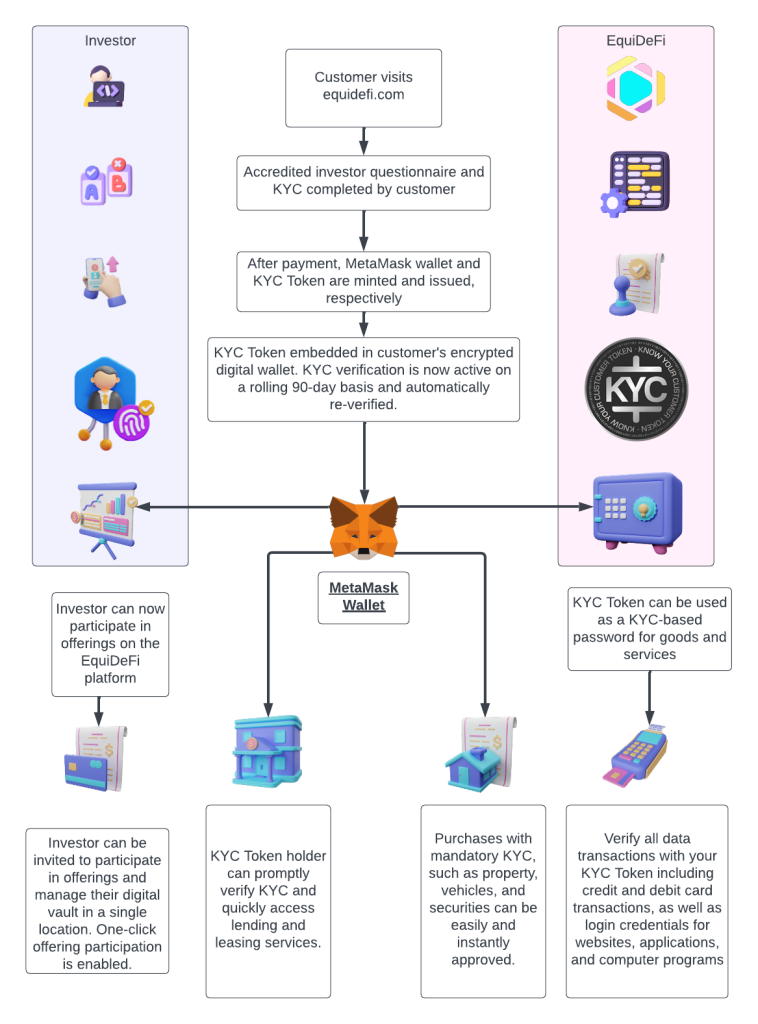

EquiDeFi® is a software platform that simplifies private offering workflows for issuers and reduces friction for accredited investor participation in private placements. The platform enables issuers to manage, offer, and close private offerings and provides an investor dashboard for securely accessing investment records. EquiDeFi® also offers education tools for investors and connects them to various services and breaks down barriers to make private placements more accessible to new investors. EquiDeFi®’s compliance engine conforms to SEC best practices and provides simplified online forms and audit trails for interactions with investors.

Our goal is to democratize and decentralize private placements, which have been restricted to institutions, professionals, and friends and family with unique access. Accredited investors can review and invest in multiple deals for up to 90 days with a single accreditation certification, and issuers can easily find investors on the platform. EquiDeFi® removes the complexity and obstacles that have previously prevented investors and issuers from realizing their full potential in private finance and makes private placements more accessible and straightforward.

Under the federal securities laws offers and sales of securities must be registered unless an exemption from registration is available. These laws frame compliance workflows to document which investors can lawfully participate. Appropriate documentation between an investor and issuer of private placements assures adequate steps have been taken, and will be required to prove exemptions sometimes years in the future. Existing workflows involve exchange of information directly between a single issuer and single investor and are cumbersome, usually paper-based or digital signature only, lacking uniformity creating compliance challenges and risk for issuers and investors alike.

EquiDeFi®, a vertical SaaS capital raise workflow platform, through its SEC-registered and affiliated stock transfer agent, Equity Stock Transfer, seeks to expand investor access to private placements while creating best practices around KYC, AML and securities workflows for a digital era.

Once an investor passes our regulatory and background checks they may be adjudged and eligible to participate in private placements of securities being made by a multitude of issuers. They are issued our “KYCT,” a proprietary Web 3.0 based confirmation of eligibility. Our KYCT will accompany our holder throughout their interactions on our site. Paid subscriptions for KYCT will be valid for 90 days and renew periodically when eligible status is reconfirmed by an investor and will be made available to any issuer seeking matches with investors through our software, rather than a single issuer soliciting that investor as currently happens nearly 100% of the time. We allow private placement issuers on our site to reach innumerable prequalified curated KYCT holders with new offerings tailored to their interests.

More information can be found on our website (www.EquiDeFi.com).

Increasingly, KYC (Know Your Customer) is a process used to describe how businesses verify the identity of counterparties to their financial interactions. KYC goes hand in hand with anti-money laundering (AML) efforts, countering the financing of terrorism (CFT), and other types of financial crimes. KYC requires businesses to obtain and verify certain information about their customers such as their name, address, date of birth, and government-issued identification. Our KYC Token serves the dual purpose of assuring compliance with federal securities laws and adding an AML and CFT layer for issuers required to or desiring these additional features.

By introducing KYC applications to our onboarding workflow, EquiDeFi® helps businesses ensure that they are not unknowingly facilitating the aforementioned criminal activities by identifying and verifying their customers’ identities. Moreover, KYC ensures the reputation and protection of businesses by reducing the risk of being associated with illegal activities. KYC is required by law in many jurisdictions, and failure to comply can result in fines and other legal consequences.

Implementing KYC as a standard practice in EquiDeFi®’s onboarding workflow has been established to help businesses comply with legal and regulatory requirements, protect themselves from financial crimes, and maintain the integrity of the financial system.

The ERC-1155 token standard is a smart contract interface that can represent any number of fungible and non-fungible token types. This Multi Token Standard allows for each token ID to represent a new configurable token type which can contain its own metadata. For EquiDeFi®’s purposes, each ERC-1155 smart contract would be a representation of individuals, companies, programs, objects, and other assets on the blockchain known as KYCT. This empowers the KYCT holder with decentralized identification and the ability to assign rights, duties, or information on a blockchain-based infrastructure.

Self-sovereign identities using ERC-1155 are stored and deployed in a decentralized manner on Flare Network as the contracts are EVM-compatible and can be deployed on any EVM (Ethereum Virtual Machine) compatible blockchain. They cannot be hidden or deleted, and the owner’s access rights persist throughout their lifetime.

However, the value of an identity lies in the information associated with it. Identity information can be self-attested or signed on the blockchain by trusted third parties such as banks, digital national ID keys, digital asset marketplaces, transfer agents, auditors, and more. These claims create identity proofs that can be utilized by token issuers, custodians, DeFi protocols, and others.

Regulated exchanges often require a “real” identity linked to a real person or organization, which is proven through an approval. Once an approver (KYCT holder) stipulates a valid operator (manager of one’s token set) these approvals can then be issued by the operator (EquiDeFi®). For example, a KYCT holder can issue an approval verifying that their identity has passed an identity check with an ID card and a selfie which has been previously captured in the initial KYC process.

Sensitive personal information (PII) is not stored publicly on the blockchain. The approval issuer receives private data verifications through integrated KYC services of the approval on secure off-chain servers and publishes a signature on-chain to attest to the data verification. Access to the private data requires explicit consent from the identity owner. The identity owner can share this information by granting access to a select operator or choose who can view their identity credentials ad hoc.

EquiDeFi® leverages ERC-1155 to issue KYC verified individuals an encrypted token to authenticate transactions in their portal. This application of KYC can be used to verify identities for any business that necessitates a compliant standard of identity verification. EquiDeFi® refreshes KYC statuses for their customers every 90 days in accordance with SEC regulatory compliance standards.

KYCT (Know Your Customer Token) is a product that combines traditional KYC processes with ERC-1155 based identity management on the EVM-based Flare Network. KYCT is a secure and efficient solution for businesses and individuals alike to verify their respective identities prior to any transactions. Additionally, KYCT holders can supply other KYCT holders or operators with signatures of approval.

KYCT allows businesses to verify the identity of their customers in a quick and efficient manner while ensuring all traditional KYC processes, such as collecting government-issued identification and other personal information have been performed. The verified identity information is stored in an end-to-end encrypted data vault. The KYCT token allows the holder to access their own vault and pull only the information required for a single event as needed. By leveraging the Flare Network, using the ERC-1155 standard, a decentralized and secure identity management system can be leveraged by the holder or on the behalf of the holder at any time by an approved operator.

When leveraging the encrypted data vaults for storage and KYCT as signature key, the individual’s identity information can be shared with businesses more easily and securely. Businesses can access the identity information of their customers in real-time, reducing the time and cost required to verify customer identities.

KYCT also provides a transparent and auditable system for regulatory compliance. The blockchain provides an immutable record of all identity verification transactions, making it easier to demonstrate compliance to regulatory authorities.

Customers who may not be familiar with token management are encouraged to have their KYCT managed by EquiDeFi®’s custodial services and use their EquiDeFi® issued MetaMask wallet. Those who are adept in web3 wallet management are free to manage their own identities and migrate their KYCT to a personal EVM wallet through multi-signature authentication.

A MetaMask wallet connection allows for future securities to reside in a KYCT confirmed identity decentralized wallet designated exclusively for the KYCT recipient by EquiDeFi®. It allows for the purchase and holding of securities digitally including allowing crypto offerings that comply with federal securities laws.

Combining KYC (Know Your Customer) with ERC-1155 for identity management on the Flare Network can provide several benefits, including:

By combining KYC and ERC-1155, businesses can create a more secure and reliable identity management system for their customers. This can help prevent identity theft, fraud, and other types of financial crimes.

As KYC is required by law in many jurisdictions, combining KYC with ERC-1155 can help businesses comply with these regulations. The transparency of the blockchain can also make it easier to demonstrate compliance to regulatory authorities.

For users who choose to self-custody their KYCT, their ERC-1155 token can be migrated to an EVM compatible wallet once all key holders agree to the migration of the token. As a decentralized identity management system KYCT is not controlled by any single entity. This can help to protect user privacy and prevent data breaches. Through EquiDeFi®’s custodial option, a distributed key ensures no single entity has control over any one KYCT.

KYC processes can be time-consuming and expensive for businesses. By using ERC-1155 based KYCT, businesses can streamline the KYC process and reduce the time and cost required to verify customer identities.

Combining KYC with ERC-1155 can provide a better user experience for customers. Customers now have the option to manage their own identities on the blockchain and have full control over how or if their identity data is shared with businesses more easily and securely.

MetaMask is a browser extension and mobile application that allows users to interact with decentralized applications (dApps) on the Ethereum blockchain. It serves as a bridge between the user’s browser (i.e. Chrome, Mozilla FireFox, Brave) and the Ethereum network, enabling them to store, send, and receive various crypto currencies, and ERC-1155 tokens such as KYCT. For EquiDeFi®’s purposes, users create a wallet with EquiDeFi® by setting a password and completing KYC. Once KYC is completed the wallet is created and their KYCT is issued to their wallet allowing users to connect it to various dApps and websites.

In the context of KYC verification, a MetaMask wallet holding its approved KYCT can now be used to verify the identity of the user. For example, a website with data sensitive services that require KYC verification may ask users to submit their personal information, such as their name, address, and date of birth, and upload a copy of their government-issued ID. The user instead uses the KYCT with their MetaMask wallet to prove their identity when accessing the website. As the KYCT serves as cryptographic proof that the user has been verified by a trusted third-party KYC provider, they are now allowed to participate in activities that require KYC verification without having to submit their personal information repeatedly.

EquiDeFi® issued MetaMask wallets provide a convenient and secure way for users to interact with data sensitive services and products. Leveraging KYCT as identity verification credentials introduces an extra layer of security and automates compliance.

XRPL is a blockchain-based payment protocol that enables fast, secure, and low-cost cross-border transactions. XRPL uses its own native cryptocurrency, XRP, as a bridge currency to facilitate transactions. Each transaction can reach consensus in as little as 3-5 seconds while using a fraction of the energy a standard fiat transaction would consume.

Although the initial intention is for EquiDeFi® to leverage the XRPL and XRP for KYCT with respect to incorporating financial transactions into the platform, Ripple’s product suite (built upon the XRPL) may prove to be valuable for EquiDeFi® in the future. As a payment protocol XRPL includes a messaging system that enables banks and financial institutions to communicate with each other in real-time. This messaging system, called Interledger Protocol (ILP), can be used to facilitate different types of transactions, including payments, securities trades, and other financial transactions.

XRPL can be used to process payments for KYCT users. EquiDeFi® aims to use the native cryptocurrency, XRP, to initiate payments while settling in fiat once the verified currency exchange has been agreed upon. Businesses can receive payments in XRP, stable coins such as USDC, or other approved crypto currencies, or choose for payment settlements in fiat at a slower transaction speed. XRPL’s payment protocol also allows for near-instant transaction settlement times, which can improve the efficiency of the payment process.

XRPL’s protocol provides a transparent and immutable record of all transactions. This can make it easier for businesses to demonstrate compliance with regulatory requirements for transactions involving KYC.

Flare is a blockchain platform that enables smart contracts to be executed on the Ethereum Virtual Machine (EVM), a computation engine responsible for deploying and executing smart contracts and computing the state for every new block added to the Ethereum blockchain. Flare was developed to enable the creation of smart contracts on the XRP Ledger. However, Flare is designed to be interoperable with other blockchain ecosystems, such as Ethereum via EVM. This allows Flare to create smart contracts that can interact with multiple blockchain networks.

Flare uses a unique consensus algorithm called the Federated Byzantine Agreement (FBA) to validate transactions on its blockchain. The FBA algorithm enables high transaction throughput and low latency while maintaining a high level of security.

Flare is a blockchain platform that enables smart contracts to be executed on the EVM. Flare can be leveraged for KYCT in several ways:

Flare can be used to store and manage customer identity information on a decentralized ledger system. This provides a secure and reliable system for identity management, which can help prevent identity theft and fraud.

Flare’s blockchain is leveraged to initiate smart contracts, which can be used to automate the KYCT process. Smart contracts can automatically verify customer identities and provide instant access to verified customers as established by EquiDeFi® in the onboarding process.

Flare is designed to be interoperable with other blockchain platforms, such as Ethereum. This allows for seamless integration with other blockchain-based products and services, such as wallets, exchanges, and other identity verification systems.

Flare’s blockchain provides a transparent and immutable record of all transactions. Compliant facing businesses are required to demonstrate stringent regulatory practices. The use of Flare’s blockchain for operations mandates a compliant workflow for all transactions.

Flare can be integrated with existing systems, such as customer relationship management (CRM) software and payment processing systems such as Ripple, to provide a seamless and efficient KYCT onboarding and participatory process.

The Flare network’s interoperability with the XRPL can provide several benefits when building KYCT on Flare. By leveraging Flare’s blockchain technology for KYCT, EquiDeFi® can provide a more secure, efficient, and compliant solution for businesses to verify the identity of their customers. Flare’s interoperability and smart contract capabilities can enable integration with the XRP Ledger, providing a more comprehensive identity verification and transaction solution.

Flare is designed to be interoperable with the XRP Ledger. With this interoperability EquiDeFi® can leverage Flare’s integration with the XRP Ledger to access its features, such as the ability to send and receive XRP payments, and to execute transactions on the XRP Ledger.

As mentioned previously, EquiDeFi envisions collaborating with Ripple in the future, to integrate with Ripple-based products and services.

Below is additional information regarding the range of products and services that are built on top of the XRPL that could serve as ancillary services for EquiDeFi and KYCT.

An interbank communications and settlement software built around the Interledger Protocol (ILP). The ILP is an open protocol that enables interoperation between different ledgers and payments networks.

xRapid is a software solution to provide liquidity, which allows companies to swap in and out of XRP to optimize exchange rate efficiency. In simple terms, XRP can be used in xCurrent as a bridge currency to settle transactions. Without a bridge asset, the spreads can be quite high between infrequently traded currencies, which results in expensive trades.

In Ripple’s product ecosystem, xVia is a standardized payment interface into RippleNet (the network of financial institutions using xCurrent or xRapid to settle payments) designed for corporations, payment providers, and banks who want to send payments across various networks using a standard interface. xVia’s simple API requires no software installation and enables users to seamlessly send payments globally with transparency into the payment status.

By leveraging Flare’s interoperability with XRPL, EquiDeFi® could integrate KYCT with these products and services, enabling seamless identity verification and payment processing all under one compliant umbrella.

Flare’s interoperability with the XRPL also means that one could build KYCT solutions that work across multiple blockchain networks, such as Ethereum and other EVM-based networks that Flare supports. This provides more flexibility in building KYC solutions that can work with different blockchain-based products and services.

Finally, by leveraging Flare’s support for smart contract execution on EVM, one could automate the KYCT process using smart contracts. This enables faster and more secure identity verification, as well as more efficient management of encrypted KYC data on the Ethereum blockchain.

An example of a smart contract for KYCT on Flare would be a contract that automates the identity verification process for onboarding a prospective investor.

KYCT will not only be limited to securities transactions. It will be instrumental in ensuring a tightly wound retail payment experience which will include the ability to facilitate cross-border transactions, regulatory compliance and jurisdiction-specific rules, security/fraud prevention, and frictionless efficiency.

KYCT can provide many benefits to the complex world or unclaimed property and escheatment by leveraging enhanced compliance standards that meet US state-level jurisdictional regulatory requirements and international compliance standards, as applicable. KYCT can automate the escheatment process by identifying unclaimed assets through smart contracts, making the process more efficient. Proper escheatment will also ensure that unclaimed assets contribute to state revenue and are used for public benefit.

Sign up to our waitlist to get early access to the EquiDeFi® Investor platform and services.

Know Your Customer Token

an EquiDeFi® Product

1500 E. Las Olas

Suite 200

Ft. Lauderdale, FL 33301

EquiDeFi® © 2026 | Web Design by borealis.ec